Retirement Savings Contributions Credit (Saver's Credit)

Retirement Savings Contributions Credit (Saver's Credit)

The government rewards people who save for retirement. The Saver's Credit is a tax credit that puts money back in your pocket for contributing to retirement accounts. Many people qualify but don't know it exists.

What Is the Saver's Credit?

It's a tax credit for retirement contributions. You get a credit of 10%, 20%, or 50% of the money you put into retirement accounts. The exact percentage depends on your income.

This is different from a tax deduction. A deduction reduces your taxable income. A credit reduces the tax you owe dollar-for-dollar. Credits are more valuable.

You can claim this credit on your tax return using Form 8880.

Who Can Claim It?

You must meet four requirements:

Age 18 or older. Younger savers don't qualify.

Not claimed as a dependent. You can't take the credit if someone else claims you on their tax return.

Not a full-time student. Students enrolled full-time at a school for any part of five calendar months can't claim it.

Made eligible contributions. You must have put money into a qualifying retirement account.

That's it. Most working people over 18 meet these rules.

What Accounts Qualify?

The credit applies to contributions made to:

Traditional IRAs

Roth IRAs

401(k) plans

403(b) plans

Governmental 457(b) plans

SARSEP plans

SIMPLE plans

Federal Thrift Savings Plan

501(c)(18)(D) plans

ABLE accounts (if you're the designated beneficiary)

Rollover contributions don't count. Neither do distributions from accounts.

What is the Maximum Size of Your Claim?

The limit of the most contributions that can be counted to claim a credit is $2,000 for one person. The greatest sum, thus, will be $4,000 for both of you if you are a married couple filing a joint return.

To put it differently, the top credit limit is $1,000 ($2,000 in the case of a joint filing by a married couple).

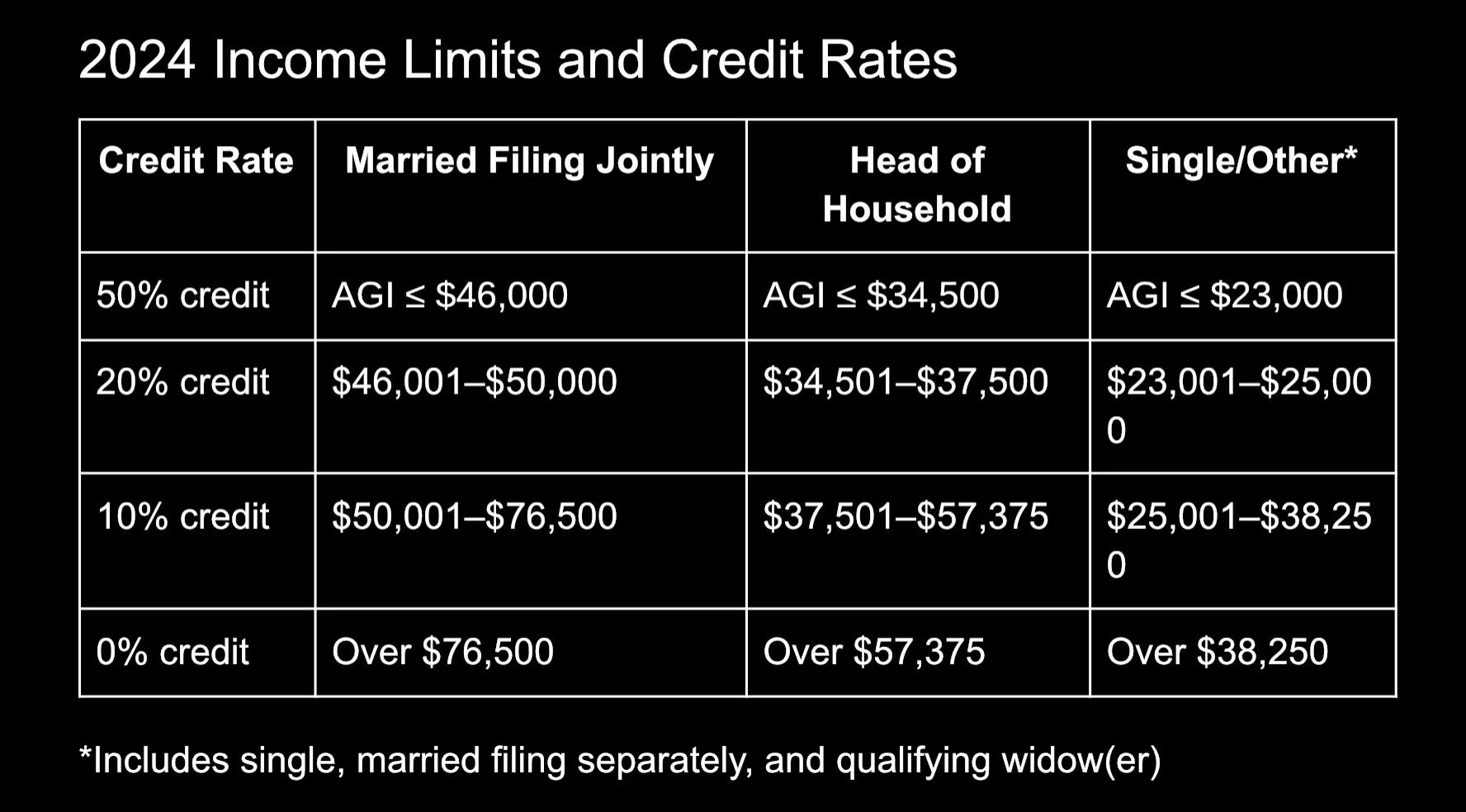

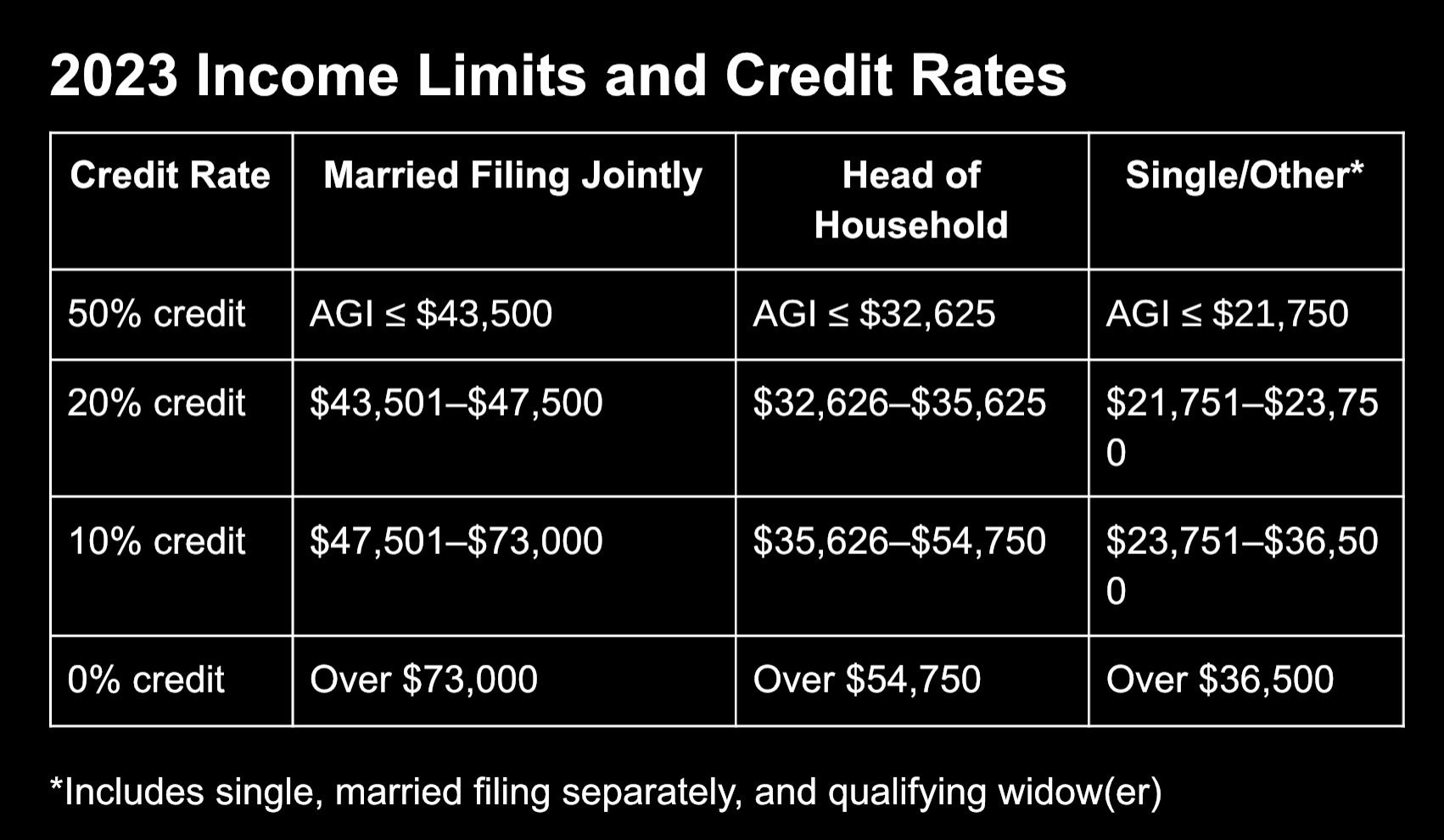

The credit that you get will be based on your income and filing status.

How to Get the Credit

The first thing to do is invest in an eligible retirement account.

After that, when you submit your tax return, fill out Form 8880. The credit amount is figured on this form.

Submit the form with your tax return. The IRS will use the credit to lower your tax bill.

This credit can be used in the same year the contribution is made.

Why It Is Important

That credit is a great relief for low and moderate-income savers. The Saver's Credit is a good incentive for people to save for retirement.

The credit works by lowering the cost of saving for retirement. You can do more with your contribution. The tax credit pays part of it.

Eventually, the little finger will turn into a big hand. A $2,000 contribution with a 50% credit means that you are actually building retirement money at a lower price.

Final Thoughts

The Saver's Credit is a direct tax benefit for retirement savers. Your income should be under a given threshold. You must be over 18 years old and not a full-time student. You should not be a dependent.

Determine your credit depending on your AGI and filing status. Find your rate by using the tables.

The credit cannot exceed $1,000 per individual or $2,000 for married couples.

If you set aside money for retirement and your annual income is less than $76,500 (or $38,250 if you are single), you should figure out if you are eligible. This free money is yours to take. Many people are missing it simply because they are not aware of its existence.

Submit your tax return along with Form 8880 to get the credit. It is always best to contact a tax professional with questions so that you can maximize your benefits.